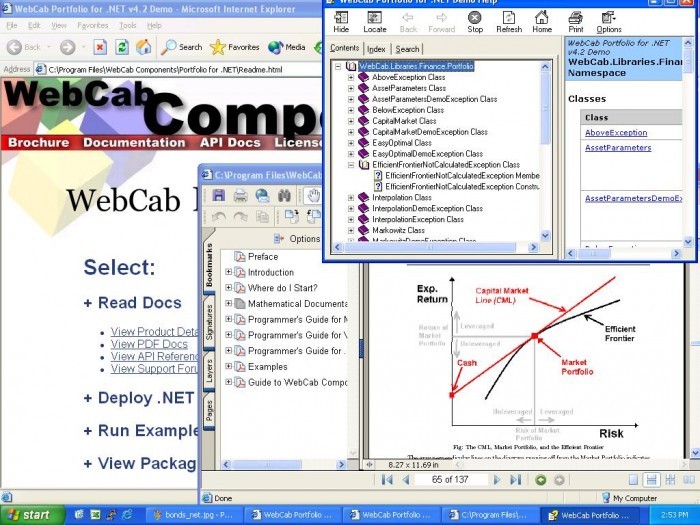

.NET, COM and XML Web service implementation of Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints. Also includes Performance Evaluation, interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML.

Publisher description

COM enabled .NET Component and XML Web service implementation offering the application of the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML.

Related Programs

Portfolio Performance Monitoring 3.2

Portfolio Performance Valuation Tracking

WebCab Portfolio for Delphi 5.0

Add Markowitz Th. and CAPM to .NET/COM/WS App

WebCab Portfolio (J2SE Edition) 5.0

Markowitz Theory and CAPM: Optimal portfolio

WebCab Portfolio (J2EE Edition) 5.0

Markowitz Theory and CAPM: Optimal portfolio

PNG Icon Portfolio 2016.1

PNG Icons Instantly Delivered!